Dec 3 (Reuters) – China on Tuesday banned exports to the United States of the critical minerals gallium, germanium and antimony that have widespread military applications, escalating trade tensions the day after Washington’s latest crackdown on China’s chip sector.

The curbs strengthen enforcement of existing limits on critical minerals exports that Beijing began rolling out last year, but apply only to the U.S. market, in the latest escalation of trade tensions between the world’s two largest economies ahead of President-elect Donald Trump taking office next month.

A Chinese Commerce Ministry directive on dual-use items with both military and civilian applications cited national security concerns. The order, which takes immediate effect, also requires stricter review of end-usage for graphite items shipped to the U.S.

“In principle, the export of gallium, germanium, antimony, and superhard materials to the United States shall not be permitted,” the ministry said.

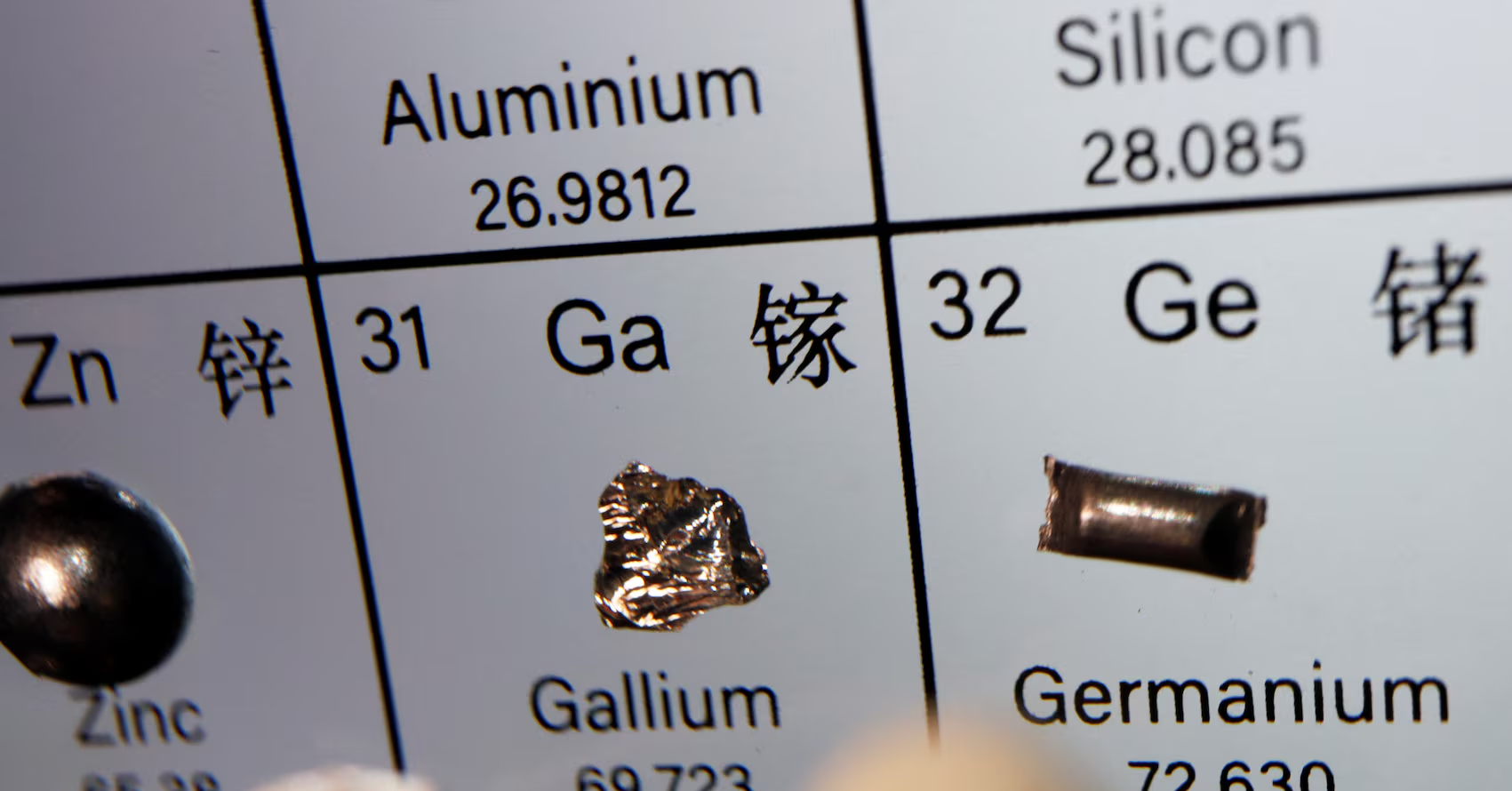

Gallium and germanium are used in semiconductors, while germanium is also used in infrared technology, fibre optic cables and solar cells. Antimony is used in bullets and other weaponry, while graphite is the largest component by volume of electric vehicle batteries.

The move has sparked fresh concern that Beijing could next target other critical minerals, including those with even broader usage such as nickel or cobalt.

“China has been signalling for some time that it’s willing to take these steps, so when is the U.S. going to learn its lesson?” said Todd Malan of Talon Metals (TLO.TO)

, opens new tab, which is trying to develop a nickel mine in Minnesota and is exploring for the metal in Michigan. The only U.S. nickel mine will be depleted by 2028.

The United States was assessing the new restrictions, but will take “necessary steps” in response, a White House spokesperson said, without giving details.

“These new controls only underscore the importance of strengthening our efforts with other countries to de-risk and diversify critical supply chains away from PRC (China),” the spokesperson said.

Representatives for Trump did not immediately respond to a request for comment.

Chinese customs data show there have been no shipments of wrought and unwrought germanium or gallium to the U.S. this year through October, although it was the fourth and fifth-largest market for the minerals, respectively, a year earlier.

Similarly, China’s overall October shipments of antimony products plunged by 97% from September after Beijing’s move to limit its exports took effect.

China accounted last year for 48% of globally mined antimony, which is used in ammunition, infrared missiles, nuclear weapons and night-vision goggles, as well as in batteries and photovoltaic equipment.

This year, China has accounted for 59.2% of refined germanium output and 98.8% of refined gallium production, according to consultancy Project Blue.

“The move is a considerable escalation of tensions in supply chains where access to raw material units is already tight in the West,” said Project Blue co-founder Jack Bedder.

Prices of antimony trioxide in Rotterdam had soared by 228% since the beginning of the year to $39,000 a metric ton on Nov. 28, data from information provider Argus showed.

“Everyone will dig in their backyard to find antimony. Many countries will try to find antimony deposits,” said a minor metals trader in Europe, declining to be named.

Perpetua Resources (PPTA.O)

, opens new tab, which is developing an Idaho antimony mine with U.S. government financial support, said China is “weaponizing accessing” to minerals critical for the U.S. military and technology firms.

“We must get serious about American mineral sources,” said Perpetua CEO Jon Cherry. “It’s time to end our reliance on China and secure our future.”

United States Antimony (UAMY.A)

, opens new tab, which refines antimony in Montana, said it believes China’s move will boost prices of the metal and thus increase supplies for its smelter, although the company acknowledged that it will take time for mines to be developed.

China’s announcement comes after Washington launched its third crackdown in three years on China’s semiconductor industry on Monday, curbing exports to 140 companies, including chip equipment maker Naura Technology Group (002371.SZ)

Trump, whose first four-year White House term was marked by a bitter trade war with China, has said he will implement 10% tariffs on Chinese goods and threatened 60% tariffs on Chinese imports during his presidential campaign.

“It comes as no surprise that China has responded to the increasing restrictions by American authorities, current and imminent, with its own restrictions on the supply of these strategic minerals,” said Peter Arkell, chairman of the Global Mining Association of China.

“It’s a trade war that has no winners,” he said.

Separately, several Chinese industry groups on Tuesday called for their members to buy domestically made semiconductors, with one saying U.S. chips were no longer safe and reliable.

Sign up here.

Reporting by Amy Lv, Ella Cao and Ryan Woo in Beijing, Tony Munroe in Singapore, Ashitha Shivaprasad in Bengaluru, Trevor Hunnicutt in Luanda and Ernest Scheyder in London; Editing by Jan Harvey, Catherine Evans, Barbara Lewis and Jonathan Oatis

Our Standards: The Thomson Reuters Trust Principles.